Investing in Precious Metals. Gold, Silca, Feldspar & Mica

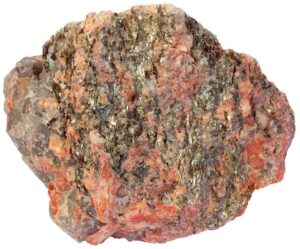

Investing in Precious metals, Gold, Silca, Feldspar and Mica. When we think of precious metals, our minds often go straight to gold silver or diamonds. But beneath the earth’s surface there are many different precious metals and one of them is silca, Feldspar and Mica. In this blog we are going to explore the beauty of investing in precious metals like Gold, Silca, feldspar and Mica. Meanwhile contact a mineral expert from Jesa Minerals your safe place for Gold and Copper trading in Africa

What are precious metals

Precious metals are rare, naturally occurring metallic elements of high economic value. They are often used in different aspects of life. There are some metals that are used in industries and factories and these include Gold itself, copper, Silca, Feldspar, and Mica. Look into the products.

Types of Precious Metal worth an investment

- Gold its self: Its highly valued metal, gold is often used in jewelry, coins, store of value and percentage used in industries.

- Silica: Its one of the abundant minerals o earth and its used in industries for production of glasses. From windows and bottles to optical fibers and smartphones. It can also be used in construction and technology applications

- Feldspar: Its that metals that is mixed with aluminum and silicate content. Its one of the key ingredients in ceramics and glass production. It can also be used in Aesthetic applications.

- Mica; Its known for its unique layered structure that allows it to be split into thin, flexible sheet. This mineral is not only aesthetically attractive but also functionally versatile. Its used in Electrical Insulation, cosmetics and in industries

- Chrome: Chrome is essential to several high performance materials like it gives stainless steel its corrosion resistance, used to make refractory bricks and linings of furnaces.

Benefits of investing in precious metals

- Store of value: Precious metals serve as a storage of value, maintaining their purchasing power over time.

- Diversification: Investing in Precious metals can diversify your investment portfolio, reducing risk and increasing potential returns

- Hedge against inflation: Investing in precious metals tend to appreciate in value during times of economic uncertainty and inflation.

Ways of investing in Precious metals

- Mining stocks: Investing in companies that mine precious metals

- Futures Contracts: They are for buying and selling contracts for future delivery of precious metals

- Exchange Traded Funds ETFs: They are for tracking the price of precious metals

- Physical Metals: The buying of physical gold, silver, platinum or palladium coins or bars

In Conclusion

Investing in Precious metals offer a unique investment opportunity, providing diversification, a hedge against inflation and store of value. Whether you’re a seasoned investor or just starting out, understanding the world of precious metals can help you make informed investment decisions.

FAQs

1 What are the most common precious Metals?

The most common precious metals are gold, silver, platinum and palladium

2 Are precious metals liquid?

Precious metals can be liquid depending on market demand and the specific metal

3 Can I be investing in precious metals through my retirement account?

Yes, you can be investing in precious metals through certain retirement accounts, such as self redirected IRA

4 What are the risks of investing in precious metals.

Risks include market volatility, price changes storage and security concerns for physical metals

REACH OUT TO YOUR EXPERT TO START YOUR MINERAL INVESTMENT WITH US